Apple Pay: Advancement Or Copycat?

By Kristen Gramigna, BluePay

Speculation, kudos and critiques of Apple Pay have dominated consumer, financial and tech headlines since the company announced the pending release of the product on Sept. 9, but similar mobile payment products, including Google Wallet and PayPal One Touch, have been available to consumers since 2011. Does Apple Pay really deserve all the attention, or is it just a copycat version of its predecessors? Here's a look at why Apple Pay may be a new breed of mobile wallet.

It has a unique value proposition. Despite the availability of mobile wallets, the idea has been slow to flourish beyond early adopters. In a recent IDC Financial Insights survey on mobile payment adoption, less than 40 percent of consumers said they're receptive to using mobile payments at all, prompting IDC to surmise that "emerging payment methods must provide unique value proposition to drive adoption."

Particularly following a string of large scale data breaches that have occurred over the last year (such as what impacted more than 70 million consumers who shopped at Target during the 2013 holiday season), consumers are likely ready to hear about new solutions aimed at protecting their financial data. Because Apple Pay leverages a reinvented data infrastructure for payment processing, limiting the amount of sensitive data that is shared with merchants, credit card networks, payment processors and the mobile device itself, Apple Pay may be the solution consumers require of a mobile wallet, beyond being a "convenient" way to pay.

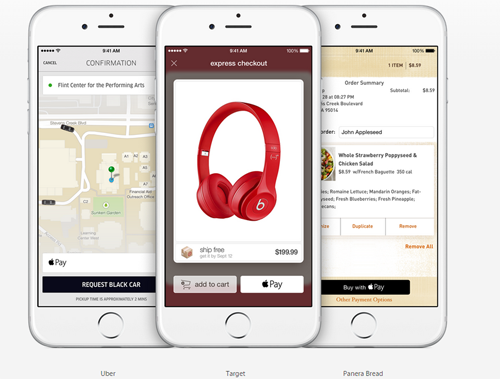

Here consumers can pay for Uber, Target and Panera using Apple Pay.

Thanks to tokenization, which assigns random numbers to identify, process and verify Apple Pay transactions, identifying customer information is immediately encrypted as soon as a consumer creates an Apple Pay account. Data is sent securely to the associated credit card network, which responds with an equally random, 16-digit number (called a "token") upon verification. That number is sent to the Apple device and stored in the "Secure Element." Each transaction the consumer makes is also validated by a dynamic security code. In short, consumers should feel more protected with Apple Pay because it's a different mode of payment processing and data transmission altogether. Assuming Apple can clearly communicate that benefit to the public, it will likely establish the unique value proposition that IDC Financial Insights says is necessary to transform the mobile payments space.

Partnerships are deeper than a marketing effort. Though Apple Pay's partnerships with more than 200,000 retailers indicate it's equipped to overcome the lack of merchant acceptance that has hindered mobile wallet adoption to date, the reality is that many retailers have been equipped with near field communications (NFC) terminals for several years. (In fact, Google Wallet was equipped to work with more than 300,000 MasterCard PayPass merchant locations back in 2011.)

What makes Apple's relationships different? Its partnerships aren't just about convenience-message marketing, but rather, a shift in payment technology that has been publicly voiced and embraced within the banking community by major financial brands like Chase, Bank of America and American Express. In fact, experts at The Financial Brand predict that NFC payments will soon become the standard in point of sale payments, replacing both signature-based and chip-and-PIN transactions. Where consumers once saw an NFC terminal and maybe didn't quite know what to do with it, such shared industry support will now create a perception of an NFC terminal as a more secure way to transact.

A list of just some of the stores that accept Apple Pay.

Consumers are already primed for adoption. Apple has proven its ability to move markets, evidenced by the iPod, iTunes, the iPhone and the iPad. An estimated 800 million consumers have already been convinced that Apple is a trusted and viable payment vehicle, having established an iTunes account, supported by stored and sensitive payment information. The hurdle to adoption for these consumers is low; converting to the Apple Pay system requires making a single click to integrate existing iTunes payment data into Apple Pay.

Author Bio: Kristen Gramigna is Chief Marketing Officer for BluePay, a credit card processing firm that assists businesses of all sizes accept payments through a wide range of methods, and also serves on its Board of Directors. She has more than 15 years experience in the bankcard industry in direct sales, sales management and marketing.