Big List of Accounting Software

Accounting is a burden for every business, but without a team of experts and a suite of software solutions, small business owners are particularly weighed down by handling taxes, payroll and other bookkeeping.

In fact, according to SCORE (an organization that mentors America's small businesses), the majority of small businesses spend more than 41 hours on tax preparation each year, with 31 percent spending $1,000 to $5,000 doing so and 16 percent spending $20,000 or more.

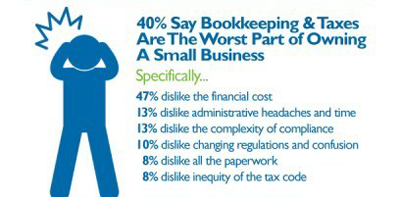

Unsurprisingly, SCORE's survey revealed 40 percent of small business owners say bookkeeping and taxes are the worst part of owning a business (see SCORE's image below), specifically 47 percent say they dislike the financial costs involved in doing so.

Further, many small business owners perform payroll duties in-house to keep costs down - with 52 percent spending 1-5 hours a month on the tasks involved.

While many business owners would not want to add on another expense that just needs to be paid each month, there are accounting solutions that may improve their productivity, as well as minimize costs associated with bookkeeping.

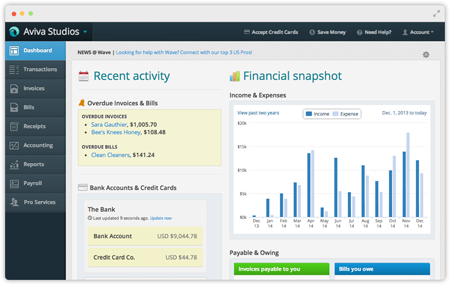

Wave

Small-business software by Wave, for example, provides 100 percent free accounting, invoicing and more, whereas its premium services (like payroll) come at an affordable price tag ($19/month for a single user of its payroll product). The compelling case that Wave makes is that it provides good online support (free), with seamless integration with the rest of Wave's products (like sales tax reports, receipt management and more).

What's more, when it's time for year-end filing, Wave can streamline that process to cut down on time and money spent doing this arduous task.

Bill.com

While Wave's offerings are distributed across accounting tasks, Bill.com's digital bread and butter are payables and receivables - which it does quite well. Also, $19/month per user, Bill.com is a faster and easier way to pay and get paid. Customers believe they have greater visibility into the bills that have been paid, what their future earnings can be and more to improve accounting processes, such as scanning bills, storing cleared checks automatically, etc.

Kashoo

Started like an online business service much like others mentioned here, Kashoo is now a cloud-based system for invoicing, expense tracking and bookkeeping. Kashoo is worth a long look if accuracy, mobility, security and simplicity are among the top considerations one has when choosing an accounting partner. Prices start at $12.95 per month.

Less Accounting

As previously mentioned, the majority of small business owners dislike bookkeeping - and this solution is for them. Less Accounting removes a lot of the bells and whistles (some call that "bloat") of many other accounting solutions - only offering simple features like for managing expenses, invoices, contacts and accounting workflows.

What's particularly impressive about Less Accounting is its third-party integrations with apps like Chase, Wells Fargo, Discover Card and more to enable business owners to import bank and credit card accounts (using bank-level security standards) so that there is less data entry.

Cheqbook

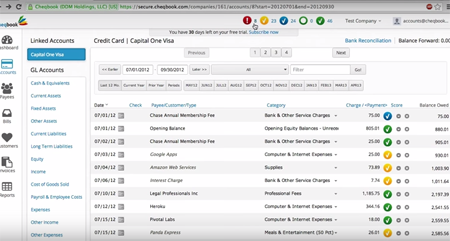

Catering to novices as well as pros, Cheqbook differentiates itself in the marketplace by offering the customization of reports, the categorization of transactions (its technology imports and categorizes transactions (which the company reports saves users an average of 80 hours a year) and unlimited simultaneous users in all plans - which start at $19.75/month but the company often runs sale (as of writing the September's sale was $9.87/month). Another feature of note is that Cheqbook provides a score to users of how accurate their books are - gamifying the importance of making books 100 percent accurate.

Surprised not to see your favorite accounting software on this list? Check out, "Money Mattters: Accounting & Finance for Web Professionals" from our October issue of Website Magazine that prompted this post, as it may have been covered in detail there.

Subscribe to Our Newsletter!

Latest in Software