End-of-Year Document Roundup for Small Business Owners

:: Corey Bray, LegalNature ::

The end of 2016 is just around the corner, which means it is time for business owners to go into overdrive handling holiday festivities, family matters, customer needs and compiling all of the necessary documents to keep business operations running smoothly in 2017.

Starting the New Year on the right foot is vital to avoid scrambling with loose ends from the year before. This means that it's time to review the past 12 months in business. Here's how to make this task organized and easy.

Analyze Financial Statements

Moving forward into 2017, it is paramount to understand where your company stands financially and how that compares to years prior.

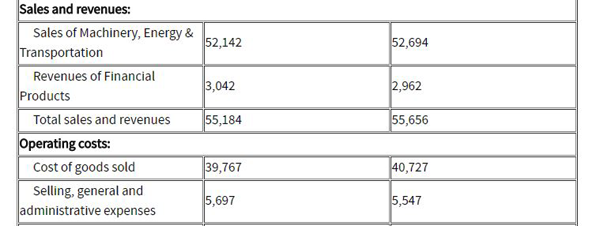

Utilizing spreadsheet data create a detailed financial report containing a profit and loss statement, a cash flow statement, and a balance sheet.

Profit and loss statements are critical to understanding the current financial wellbeing of your organization. If you find that your profits for the year are greater than anticipated, it may be wise to invest in some large corporate purchases to offset your end of year tax bill.

Cash flow statements will help owners ascertain how well monetary resources were managed throughout the year. The most important aspects to study are operating, investing and financial activities.

This is also the ideal time to review your accounts receivable to make sure any outstanding balances are paid. Establish which clients still owe you money for services rendered and those that you owe money to and get everything squared up before Jan. 1.

At the same time, be sure to review your vendor information to verify that all contact information is accurate and eliminate any data that is inactive or no longer useful.

Product Accuracy

If your company keeps physical inventory stored in warehousing facilities or on-site, be sure to organize an inventory count to ensure accuracy before the year is out. If discrepancies are found, conduct an investigation to determine where the loss occurred.

Tax Alleviation

As soon as possible, ensure that profit and loss statements and all 1099 information is reviewed to help speed up the tax preparation process.

Relieve some of the financial burden by reviewing your annual expenses and current tax deductions, plus pay off anything that can be rectified before the New Year. Another way this can be approached is through providing employees with education services. This helps to make members of the organization more valuable while also providing fiscal benefits.

Another area of focus is to ensure that your company is up to date on any and all tax changes from the year, such as Affordable Care Act compliance.

Prepare for the Year Ahead

As with every year before it, moving into 2017 requires a plan of action. To ensure that your business is advancing in a profitable direction, review your company website's analytics for the year. Document things like time-on-site and bounce rates, traffic, and conversions to determine which areas need improvement.

Take customer feedback into consideration as well. These findings can help to bolster an organization's customer service, operating procedures and identify unmet consumer needs.

All of this information can then be used to make informed decisions on future business and marketing plans, brand messages, goals, opportunities and other crucial areas for business growth.

The end of the year is crunch-time for many business owners. By getting as many of these tasks out of the way early on, corporate leaders free up more time to plot future domination and spend quality holiday time with their favorite folks.

Which of these tasks have you already completed? Which are the hardest to accomplish? Let us know in the comments below!

Corey Bray is the CEO and Founder of LegalNature. A serial entrepreneur, Corey has successfully exited several startups and is currently focused on revolutionizing the business document industry.

Subscribe to Our Newsletter!

Latest in Marketing