How SBOs Make Vendor Selections

by Amberly Dressler

14 Aug, 2017

B2B salespersons would love to get in the mind of the average small business owner (SBO) to understand what makes them stay with a vendor, choose a new one, and buy new products or services for their businesses altogether.

Through software, this is somewhat possible (predicting churn, analyzing interaction points and more), but asking small business owners outright is a good place to begin as well.

BizBuySell surveyed 1,200 owners as well as used U.S. Census data and its own assumptions to determine how spending has changed from its last survey (conducted five years ago in a time of arguably more economic uncertainty having just experienced the "Great Recession.").

BizBuySell surveyed 1,200 owners as well as used U.S. Census data and its own assumptions to determine how spending has changed from its last survey (conducted five years ago in a time of arguably more economic uncertainty having just experienced the "Great Recession.").

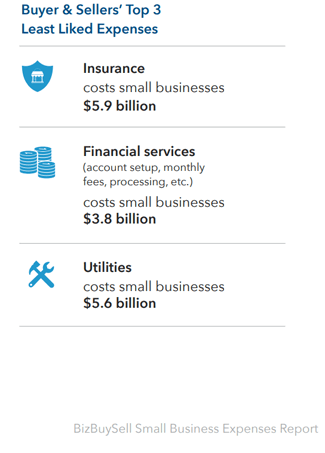

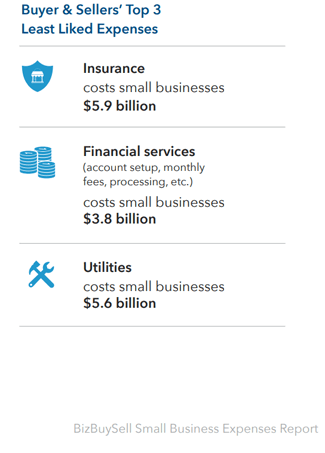

One of the report's major findings is that total spending is up: small business owners spend $42 billion annually on supplier services and products in the year before and after a business is sold, an 18 percent increase from the $35.5 billion recorded when the survey was last conducted, in 2012. What do owners not like spending money on? The three least-liked expenses from buyers and sellers are insurance, financial services and utilities - indicating vendors in these industries need to provide compelling experiences during outreach and onboarding as SBOs are dreading the process.

Once an SBO buys these services, however, they are more likely to stay. The report found small businesses were especially loyal to vendors in the utilities (30 percent), insurance (24 percent) and office supplies (22 percent) space.

Price is, of course, often a top consideration for vendor selection. To cut costs, SBOs tend to renegotiate contacts and service charges (most popular choice), look for tax deductibles (second most popular choice), and forego traditional marketing costs for word-of-mouth or free services (third most popular choice). What this should tell vendors is that if an SBO is showing signs of churn (contacting them about pricing, not engaging with marketing collateral the way they once did, not signing into a product as frequent, etc.) that they may be looking for a way to cut costs.

Price is, of course, often a top consideration for vendor selection. To cut costs, SBOs tend to renegotiate contacts and service charges (most popular choice), look for tax deductibles (second most popular choice), and forego traditional marketing costs for word-of-mouth or free services (third most popular choice). What this should tell vendors is that if an SBO is showing signs of churn (contacting them about pricing, not engaging with marketing collateral the way they once did, not signing into a product as frequent, etc.) that they may be looking for a way to cut costs.

By proactively looking at their contract or offering them content about small business advice (like tax deductibles or other areas that could help them maximize profits and/or marketing efforts), the small business can see the vendor as a valuable partner and not simply a cost center. From the research, it is clear SBOs do not want to change vendors, so vendors need to support them before, during and after the sale to retain their business - a single point of contact could help in this regard as could self-service capabilities that empower the owner and/or dynamic pricing that considers market conditions.

After all, most of these SBOs came to the vendor by a referral, so they likely already hold the vendor in high regard. It's up to the vendor to maintain that reputation and obtain additional referrals as a result.

The full report can be accessed here.

Through software, this is somewhat possible (predicting churn, analyzing interaction points and more), but asking small business owners outright is a good place to begin as well.

BizBuySell surveyed 1,200 owners as well as used U.S. Census data and its own assumptions to determine how spending has changed from its last survey (conducted five years ago in a time of arguably more economic uncertainty having just experienced the "Great Recession.").

BizBuySell surveyed 1,200 owners as well as used U.S. Census data and its own assumptions to determine how spending has changed from its last survey (conducted five years ago in a time of arguably more economic uncertainty having just experienced the "Great Recession.").

One of the report's major findings is that total spending is up: small business owners spend $42 billion annually on supplier services and products in the year before and after a business is sold, an 18 percent increase from the $35.5 billion recorded when the survey was last conducted, in 2012. What do owners not like spending money on? The three least-liked expenses from buyers and sellers are insurance, financial services and utilities - indicating vendors in these industries need to provide compelling experiences during outreach and onboarding as SBOs are dreading the process.

Once an SBO buys these services, however, they are more likely to stay. The report found small businesses were especially loyal to vendors in the utilities (30 percent), insurance (24 percent) and office supplies (22 percent) space.

Price is, of course, often a top consideration for vendor selection. To cut costs, SBOs tend to renegotiate contacts and service charges (most popular choice), look for tax deductibles (second most popular choice), and forego traditional marketing costs for word-of-mouth or free services (third most popular choice). What this should tell vendors is that if an SBO is showing signs of churn (contacting them about pricing, not engaging with marketing collateral the way they once did, not signing into a product as frequent, etc.) that they may be looking for a way to cut costs.

Price is, of course, often a top consideration for vendor selection. To cut costs, SBOs tend to renegotiate contacts and service charges (most popular choice), look for tax deductibles (second most popular choice), and forego traditional marketing costs for word-of-mouth or free services (third most popular choice). What this should tell vendors is that if an SBO is showing signs of churn (contacting them about pricing, not engaging with marketing collateral the way they once did, not signing into a product as frequent, etc.) that they may be looking for a way to cut costs.

By proactively looking at their contract or offering them content about small business advice (like tax deductibles or other areas that could help them maximize profits and/or marketing efforts), the small business can see the vendor as a valuable partner and not simply a cost center. From the research, it is clear SBOs do not want to change vendors, so vendors need to support them before, during and after the sale to retain their business - a single point of contact could help in this regard as could self-service capabilities that empower the owner and/or dynamic pricing that considers market conditions.

After all, most of these SBOs came to the vendor by a referral, so they likely already hold the vendor in high regard. It's up to the vendor to maintain that reputation and obtain additional referrals as a result.

The full report can be accessed here.

Amberly Dressler

Head of analyst relations, public relations, customer advocacy (People Heroes), customer community, content marketing (full funnel/lifecycle), content operations and optimization, reputation management and social media. Leads a team of nine superstars to exceed our goals multi-fold.

Subscribe to Our Newsletter!

Latest in Software