POV: Facebook's Identity Crisis

Facebook recently released its Q1 2017 results and the numbers are somewhat of a mixed bag, similar to how the network seems to be approaching product development these days.

To understand what is up at Facebook, it is first important to understand key facts about its user growth. While an 18 percent year-over-year (YOY) increase in daily active users (1.28 billion) and 17 percent YOY growth in monthly active users (1.94 billion), or MAUs, are enviable numbers, Facebook's North American audience will soon hit its peak. Facebook already reports that approximately 85.8 percent of its daily active users (DAUs) are outside the U.S. and Canada, and it is these audiences that will continue to drive user growth.

Since 2014, MAUs in North America (Facebook combines U.S. and Canada) have risen an average of 2 million users each quarter. In comparison, the average quarterly MAU growth in Asia-Pacific is 31.25 million users (also since 2014), according to SEC filings. Despite not accounting for a significant percentage of its user base, Facebook's North American presence is its most profitable.

Revenue in U.S. and Canada (again, combined) is more than double that of all regions (in some cases accounting for almost five times the profit) - likely due to a greater abundance of businesses willing and able to advertise on the platform. When all populations outside of North American are combined, however, they narrowly surpass the U.S. and Canada in revenue.

With the majority of those on the Internet in the U.S. already using Facebook, the social network is at a critical phase of its existence in terms of both acquisition and retention. On one hand, Facebook needs to retain its current and profitable user base in North America (not losing them to other networks). On the other, it needs to acquire the next generation of profitable, North America-based users while doing the same with new, potentially profitable users in other geographic markets and convincing businesses they are a viable option to advertise with simultaneously.

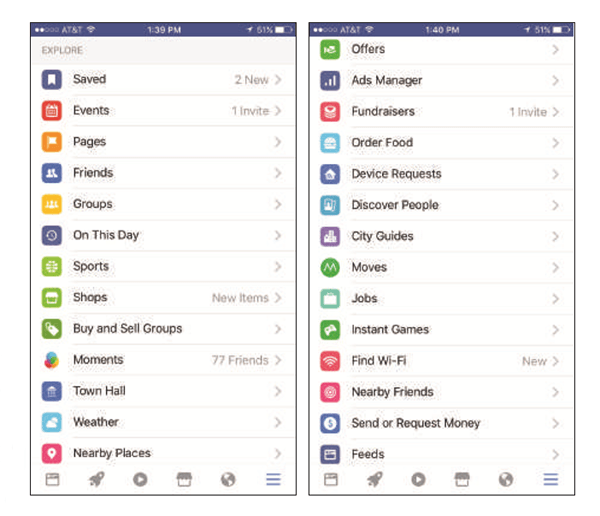

In the U.S., Facebook is having an identity crisis though. Whether it is self-growth or self-preservation, Facebook is confusing its most loyal and most profitable audiences with features that do not even fit in one mobile screenshot (see images).

Some of the features available have been made popular elsewhere. Does Facebook need to focus on the ability to collaborate with colleagues when Slack's offering is exponentially better? Does Facebook need to provide sports scores when people are trained to find them elsewhere (push notifications from ESPN or a quick Google search)? Does Facebook need to work with partners to enable users to order food when they already know they can go to Grubhub, Eat24 or a variety of other services? Probably not.

User acquisition is important, of course, but focus is critical. If increased in-app time is the goal, it makes sense, but Facebook is becoming such a desperate mish-mash of product when it does not need to be.

In its early days - and every time new reports surface of young people leaving Facebook for other networks - there was a natural comparison between Facebook and MySpace. After all, MySpace was our first look at what happens when people leave a network for another.

When will Facebook become like MySpace, losing favor forever? The answer is likely never. The world has never seen an online community presence like Facebook, and despite managing growth and acquisition being extremely difficult for companies large and small, Facebook does not have to be everything to everyone and lose itself in the process.

Like your business may as well, Facebook needs focus. We are all hooked anyway, so let us have cake over at Eat24 and post a photo of us eating it on Facebook too.

Subscribe to Our Newsletter!

Latest in Social Media