New Blockbuster Survey: Merchants Report Dramatic Increase in Chargebacks

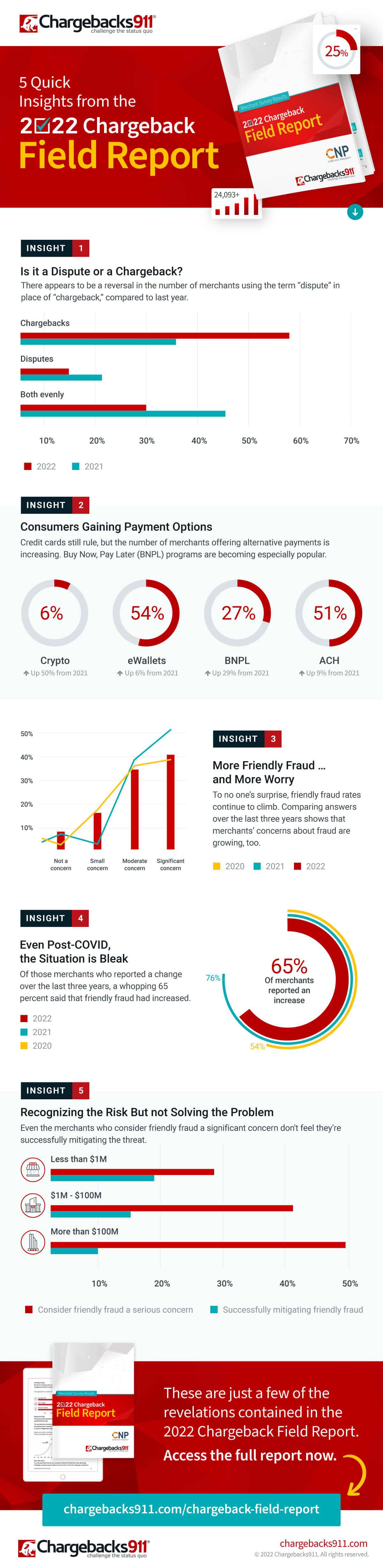

Each year, Chargebacks911 releases an annual Chargeback Field Report. It provides an industry-wide snapshot of the trials and tribulations of online merchants, uncovering fraud trends and other challenges in the card-not-present payments space. The latest report, released in July of 2022, is the most comprehensive and thorough examination to date, with over 300 merchants meticulously surveyed.

Alas, what we uncovered was deeply distressing:

After a record-setting rise in chargeback fraud, driven largely by the COVID-19 pandemic, many merchants were hoping for financial relief and a return to payment normalcy in 2022. Instead, 65% of the merchants surveyed reported an increase in chargeback fraud - a shocking statistic that could have dire consequences for an economy still reeling from inflation and supply-chain breakdowns.

The report's conclusion? The chargeback threat is growing faster than ever. It's not a one-off abnormality from the COVID pandemic (and subsequent lockdowns) but an ongoing crisis that continues to escalate. For many merchants, the chargeback threat is now growing at a rate that's utterly cannibalizing their threadbare profit margins and triggering a dramatic rise in the cost of their businesses, which is exceeding their capacity to buy and sell products and services.

Clearly, such a path is economically unsustainable.

According to the new report, the number of merchants taking steps to mitigate friendly fraud has more than doubled over the past year, rising to over 75% from 2021. The year-to-year growth indicates a greater awareness of the revenue-sapping danger of runaway friendly fraud, cyber-theft and chargeback abuse.

But, at the same time, only 18% reported that their efforts were successful.

Card networks are also becoming more active in stopping disputes before they get to chargeback status. For example, Visa's Rapid Disputes Resolution (RDR) has helped give merchants more control. On average, survey participants currently enrolled in the program reported a 34% decrease in chargebacks.

This is very important because there's a growing number of FinTech tools and services that can help merchants overcome the chargeback epidemic - and it's painfully obvious that far too many merchants are in desperate need of help.

The Chargebacks911 2022 Field Report also noted that merchants are reverting to using the term "chargeback" to refer to payment disputes (after Visa replaced the word "chargeback" with "dispute" for its brand, previous research had shown merchants slowly adapting to the change). This report, however, shows a significant drop in usage for the newer term.

So there's a new lexicon emerging among online merchants - and a greater willingness to directly address the chargeback problem. Perhaps the problem has now gotten too big for merchants to ignore. (And those who ignore it do so at their own peril, as the financial data plainly reveals.)

While credit cards are still the primary payment method used online for buying, the number of alternatives is increasing. "Buy Now Pay Later'" is surging; 27% of merchants in the survey say they offer it - up 29% from last year. Both eWallets and Automated Clearing House (ACH) transfers are now accepted by more than half of respondents.

This data is pivotal in tracking how businesses are handling friendly fraud coming out of a pandemic and moving into what could be an even tougher economic climate: Inflation is hitting generational peaks; supply-chain woes are making deliveries increasingly unpredictable; and international conflicts and global rivalries are reshaping the eCommerce ecosystem.

And chargebacks are still surging.

Like it or not, our world is rapidly evolving. For online merchants to be successful in 2022 - and beyond - they must evolve with it.