Can Retailers Survive Amazon's Entrance Into Subscription Fashion?

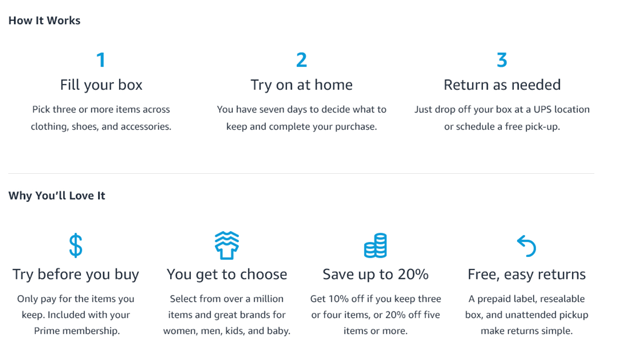

Announced last month, Prime Wardrobe allows Prime members to pick three or more items across clothing, shoes and accessories, try on the items at home and return whatever they'd like in the pre-paid box (paying only for what they buy).

People who have already used similar services through Stitch Fix, Bombfell or others are likely very open to trying Wardrobe (no fees, easy returns, ability to choose their own items and price points) while those who have not tried subscription fashion are likely more willing to do so with a household name, Amazon. It is not only consumers' willingness to try subscription fashion that could change many aspects of retail, however. Website Magazine took the opportunity to interview Isabelle Roussin, global vice president of SAP Hybris Revenue Solutions, to gather insights into how Amazon could impact the recurring revenue business model and retail in general.

What were your initial thoughts when you heard about Amazon's launch of "Prime Wardrobe"?

Roussin, SAP Hybris: I was not surprised at all to see Amazon going into subscription fashion. This news speaks volumes to the consumer demand for more retail subscription options, which provide more value and personalization to each customer.

While the retail market is projected to have the highest degree of digital disruption through 2020, retailers are constantly shifting focus from product-based to more consumer-centric and experience-based strategies. In this, we should expect subscription commerce to continue to be a mainstream part of our lives. Signing up to meet your stylist virtually, previewing clothing options before shipment, and ordering 10 items, but only paying for the clothes you keep are all concepts consumers are now familiar with thanks to companies such as TrunkClub and Stitch Fix. Amazon does have some strength over their competition, including, a well-oiled and scalable order to delivery to cash process, promotions management and valuable insights into consumer preference based on their history of search patterns.

Is there room for new subscription companies? Why/why not?

Roussin, SAP Hybris: We, at SAP Hybris, have seen firsthand the expansion of the subscription economy. While markets such as the high-tech, media, and telecom have experienced these new business models for quite some time, more and more industries are embarking on subscription models as well. Every day we see new examples, for example in the mineral industry, there's a shift to selling the tonnage of minerals hauled rather than the actual mining equipment. Another example is selling air-as-a-service rather than selling a compressor.

By 2018, 40 percent of the top 100 discrete manufacturers and 20 percent of top 100 process manufacturers will provide product-as-a-service platforms to deliver value as an integrated product and service offering versus a stand-alone function (source).

Sustaining a subscription model involves assessing what the lifetime value of customers, or groups of customers is likely to be. This means being able to assess how recently a customer has been buying, how often he buys and finally how much he spends. At the end of the day, the consumer should be able to think that he got so much more from it than he used to.

What benefits do subscription models provide?

Roussin, SAP Hybris: As subscription models continue to grow, new business models will also emerge as consumers get more comfortable engaging with brands in different ways. We're already starting to see the subscription model expand to sectors beyond retail, including equipment, cargo shipping, financial services, and more. While we see an opportunity for more subscription services, there are incentives for businesses to move in this direction as well. The benefits for brands include:

- Improved Business Planning

- Existing models allow retailers to plan resources and predict revenue, setting expectations for investors and shareholders

- Stronger Customer Relationships

- Subscriptions are not about selling a product and then moving to the next client, the model allows retailers to grow the relationship with the customer and cater to his evolving needs, hence building a level of trust and greater long-term loyalty

- Increased Innovation and Creativity

- With this business model already in place, retailers have the flexibility to innovate not only on deliverables, but on the service side, by inventing auxiliary services to wrap around the product. For instance, a retailer may take advantage of connected devices to bring new source of revenues streams

What does the future hold for subscription retail?

Roussin, SAP Hybris: We have begun to see more creative business models such as renting construction tools at Hilti.com, but as more business begin to adapt subscription models they need ensure they are equipped with the right order-to-cash process to expand both geographically and in their catalog of offerings. Subscriptions might sound simple to put in place at first, but there's much more into it:

- Handling partner settlement: Diversifying the offering based on local fashion brands might be necessary in order to appeal to a specific geography. This might mean creating a network of specialized partners that the retailer will have to commission. The future could mean creating a multi-sided model which starts to be more complex to manage.

- Cross-product discounts and promotions: While Amazon has introduced the possibility of promotions based on the number of articles which will be kept by the consumer, other businesses need to be able to keep track on this to compete. Possibilities include providing bundles between fashion items, or beauty care, where can cross promote discounts, throughout the different members and subscriptions of the family.

Additionally, subscription retail will increasingly monetize the treasure of data that retailers are collecting. The new value chain around data is fundamentally different -- the key lies in capturing this data produced by customer engagement, then analyzing it in real-time and transforming it into contextual reaction to create a better experience.

Anything else you'd like to add?

Roussin, SAP Hybris: To be successful in this subscription and service world, brands will need to take the proper steps first. In particular, they must prepare their front and back office capabilities, ensuring they are ready to:

- Innovate on the pricing models to go from subscription to pay-as-you-go and usage based on events, as well as on the flexibility of payments

- Handle multi-sided business models, to commission and share revenue with partners

Isabelle Roussin is the Global Vice President of SAP Hybris Revenue Solutions. In this role, she runs the Global Market Development efforts for SAP Hybris Billing and SAP Hybris Revenue Cloud solutions. Isabelle has over 30 years of experience in the creation, launch, and development of new business in the high tech and telecom industries, focused on software and transnational environments. Isabelle has always been attracted to high tech innovation, from Artificial Intelligence in her early days to hosted applications in the mid-90s, and subscription and usage-based billing in 2000, where she participated in the creation of Highdeal, a spin-off of France Telecom.

Isabelle Roussin is the Global Vice President of SAP Hybris Revenue Solutions. In this role, she runs the Global Market Development efforts for SAP Hybris Billing and SAP Hybris Revenue Cloud solutions. Isabelle has over 30 years of experience in the creation, launch, and development of new business in the high tech and telecom industries, focused on software and transnational environments. Isabelle has always been attracted to high tech innovation, from Artificial Intelligence in her early days to hosted applications in the mid-90s, and subscription and usage-based billing in 2000, where she participated in the creation of Highdeal, a spin-off of France Telecom.