Prime Day's SoLoMo Takeaways

Social Numbers

Tracx reported that from July 5 to July 11, Amazon saw plenty of social media activity surrounding their brand. They were the focus of 900,000-plus posts, more than 1 million mentions and over 3 million interactions in those five days leading up to Prime Day.

On Prime Day itself, according to Tracx, Amazon was the focus of 340,000-plus posts, over 1,595,000 interactions and more than 384,800 mentions - a 21 percent increase in posts, 43 percent increase in interactions and 23 percent increase in mentions from the day before. Total social media activity peaked Prime Day, with over 1,800,000 total posts and interactions in a single day.

Social Takeaway

What this should tell e-commerce retailers roughly three months before holiday shopping hits its peak is that they should begin setting up social listening (using their social media management platform's inbox or a sentiment analysis tool) in order to get a real-time feed of what current and potential customers are discussing. We know that the majority of brands do not reply to incoming mentions on social media, so retailers can really set themselves apart from the competition this holiday season by actively monitoring and replying to relevant messages. By taking an interest in consumers' social activity now, it will seem less forced than when a retailer's year is on the line in December.

Recommended Reading: Choice & Context in Digital Customer Service

Mobile Numbers

Last year, according to comScore, mobile accounted for 21 percent of total digital commerce dollars in Q4 2016, which is mobile's highest recorded share of online sales for a single quarter since comScore began measuring m-commerce in 2010. If Prime Day is any indication we can see higher mobile numbers both on the Web and in-app.

Pre-Prime Day, App Annie predicted that hours spent in the Amazon app would increase 35 percent. Surprisingly, that actual number almost doubled (read on).

Post-Prime Day, App Annie supplied Website Magazine the following data points and commentary:

- Amazon saw strong growth in iOS and Google Play combined downloads in the lead up to, during and in the week after Prime Day in the U.S.

- Downloads peaked on July 10, 2017 at 2.5x the average daily downloads of the 30 days prior, which was expected since Prime Day started early on July 10 at 6 p.m. PT. Prime Day (July 11) sustained a high level of downloads at 2.2x the average of 30 days prior.

- Amazon has proved that Prime Day's influence extends far beyond July 11. The week prior to July 10 and the week after July 11 saw a 25 percent lift from the average daily downloads of the 30 days prior to July 10. The heightened downloads indicates that Prime Day has successfully widened its reach, generating new app users for the company, and ultimately driving more revenue for the business through app transactions.

- Prime Day grew even faster than expected this year. U.S. consumers spent nearly 6.5 million hours in the Amazon Android phone app on Prime Day 2017, which is an impressive 60 percent growth in time spent in-app year over year from Prime Day 2016 (compared to App Annie's 35 percent projection).

Not to mention, Amazon saw impressive gains in the three days leading up to Prime Day with July 8 and 9 seeing a 20 percent lift in time spent compared to the average of the 30 days prior to Prime Day. July 10 also saw more than double the time spent in the Amazon Android phone app of July 8 and 9 and experiencing a 180 percent lift in time spent compared to the average of the 30 days prior to Prime Day.

Not to mention, Amazon saw impressive gains in the three days leading up to Prime Day with July 8 and 9 seeing a 20 percent lift in time spent compared to the average of the 30 days prior to Prime Day. July 10 also saw more than double the time spent in the Amazon Android phone app of July 8 and 9 and experiencing a 180 percent lift in time spent compared to the average of the 30 days prior to Prime Day.

Mobile Takeaway

While not every retailer has its own app, the incredible growth of in-app time spent by consumers on Prime Day indicates 2017 will see an even greater number of mobile purchases. What's more, with such impressive Amazon app numbers from Prime Day, consumers will bring their expectations for an app-like shopping experience to the mobile Web this holiday season - increasing the demands for a stellar user experience and an easy checkout process (alternative payment methods, guest checkout, etc.). We recommend reading, "Holiday Season Readiness Guide for Online Retailers" for an in-depth look at seasonal preparations.

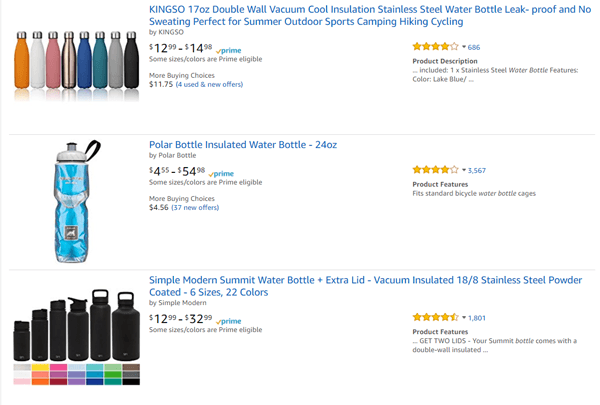

The takeaway for those merchants selling on Amazon, is to consider how their listings appear in-app. For example, app users will be more inclined than their desktop counterparts to scroll past a listing if the product title does not make it immediately clear what is being sold as this field allows for less room in-app. Take a look at how a search for "water bottles" appears in the Amazon app (above) versus how the results appear on the desktop version (below). You'll notice on the desktop version there is more room for the title and more room for product features. Images, however, can make up for what copy cannot in-app (for example, show multiple sizes and colors) so focus on images, clarity and immediacy (putting keywords toward the front of a title).

Local Numbers & Takeaway

It is no secret that Prime Day is used to help Amazon drive Prime memberships. Therefore, not only does the marketplace have revenue-earning opportunities in July, but those new and existing members will also buy in November and December. With such ease of use both in-app and on the Web, retailers will have to differentiate themselves with personalized service (both of the human kind and the technology-driven kind), match their offerings with price, payments and shipping options and set themselves apart with a clear advantage, their local stores if they have them. Buy online, pick up in store (BOPIS) is a tremendous benefit for local retailers. Consider this, half of respondents in a recent survey indicated they have used BOPIS services in the last 12 months. By offering incentives, however, that uptick could rise significantly; 80 percent of shoppers would consider using the service if retailers offered price discounts or incentives.

While there are many other takeaways to be discussed from Prime Day, knowing how the event panned out across social and mobile and understanding retailers' local advantage can help retailers start thinking about ways to compete this holiday season. Mentioned early, we recommend reading, "Holiday Season Readiness Guide for Online Retailers."

Further Reading: Clever Ways to Optimize the Web Experience for Conversion