There's One Big Reason that Banks Still Need Branches

by Amberly Dressler

25 Jul, 2017

When was the last time you walked in the bank? Or, when was the last time you even used an ATM?

It would seem that we have all gone digital with our financial transactions (online banking, online shopping, mobile apps, chip readers, PayPal, digital wallets) but it turns out that brick-and-mortar branches are still very important - for one reason. Consumers just don't trust online money management. TimeTrade's "

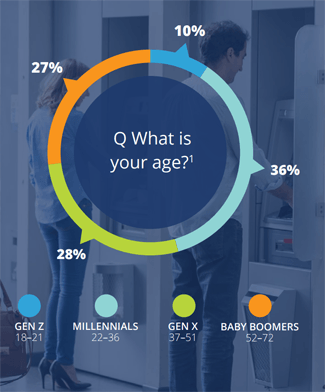

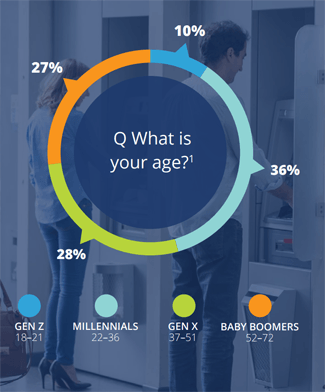

2017 State of Banking" report, which has more Millennials than Baby Booomers represented (see image), indicates that 45 percent of people would not even consider using an online-only bank. What's more, the majority of respondents (27 percent) visit a branch twice a year.

It would seem that we have all gone digital with our financial transactions (online banking, online shopping, mobile apps, chip readers, PayPal, digital wallets) but it turns out that brick-and-mortar branches are still very important - for one reason. Consumers just don't trust online money management. TimeTrade's "

2017 State of Banking" report, which has more Millennials than Baby Booomers represented (see image), indicates that 45 percent of people would not even consider using an online-only bank. What's more, the majority of respondents (27 percent) visit a branch twice a year.

Perhaps data breach fatigue is not as prevalent as we thought as customers are concerned about electronic banking with 70 percent of respondents being somewhat or very uneasy about cybersecurity issues. Even if they won't fully bank online just yet (security will need to be addressed), the main issues they have with in-person banking could be solved through digital measures.

There are many ways banks can improve their in-branch experience digitally - two big ones are self-service (kiosks or scheduling) and better employee training (apps exist, for instance, that could quiz the staff each day or software that can help them make intelligent recommendations based on the customer in front of them or customers that fit similar segments). It should be clear than when meeting customers where they want to be met, convenience will always be key and that translates to knowing who they are, what times work for them and knowing more than they already do.

It would seem that we have all gone digital with our financial transactions (online banking, online shopping, mobile apps, chip readers, PayPal, digital wallets) but it turns out that brick-and-mortar branches are still very important - for one reason. Consumers just don't trust online money management. TimeTrade's "

2017 State of Banking" report, which has more Millennials than Baby Booomers represented (see image), indicates that 45 percent of people would not even consider using an online-only bank. What's more, the majority of respondents (27 percent) visit a branch twice a year.

It would seem that we have all gone digital with our financial transactions (online banking, online shopping, mobile apps, chip readers, PayPal, digital wallets) but it turns out that brick-and-mortar branches are still very important - for one reason. Consumers just don't trust online money management. TimeTrade's "

2017 State of Banking" report, which has more Millennials than Baby Booomers represented (see image), indicates that 45 percent of people would not even consider using an online-only bank. What's more, the majority of respondents (27 percent) visit a branch twice a year.

Perhaps data breach fatigue is not as prevalent as we thought as customers are concerned about electronic banking with 70 percent of respondents being somewhat or very uneasy about cybersecurity issues. Even if they won't fully bank online just yet (security will need to be addressed), the main issues they have with in-person banking could be solved through digital measures.

There are many ways banks can improve their in-branch experience digitally - two big ones are self-service (kiosks or scheduling) and better employee training (apps exist, for instance, that could quiz the staff each day or software that can help them make intelligent recommendations based on the customer in front of them or customers that fit similar segments). It should be clear than when meeting customers where they want to be met, convenience will always be key and that translates to knowing who they are, what times work for them and knowing more than they already do.

Amberly Dressler

Head of analyst relations, public relations, customer advocacy (People Heroes), customer community, content marketing (full funnel/lifecycle), content operations and optimization, reputation management and social media. Leads a team of nine superstars to exceed our goals multi-fold.