When Will Retail Deals Wake Up from their 2016 Coma?

| Recommended Reading: This Too Shall PaaS? The Ins & Outs of Your Product as a Service. |

For these reasons, 2016 saw megadeals in retail-tech like Salesforce buying Demandware (think of the data that can be exchanged between the two cloud-based platforms) and Oracle buying NetSuite (think of the resources and scale Oracle offers NetSuite). As time passed, however, the noise died down and only industry watchers kept an eye on how those acquisitions and others were being realized. Salesforce, for example, released its Commerce Cloud just months after closing the Demandware deal. Oracle has taken a different approach, moving NetSuite as aggressively as they can globally and seemingly independently. In one interview with an Oracle executive earlier this year, Website Magazine asked what if any integrations were planned between two complementary products and the source said his product team was not in talks with NetSuite's.

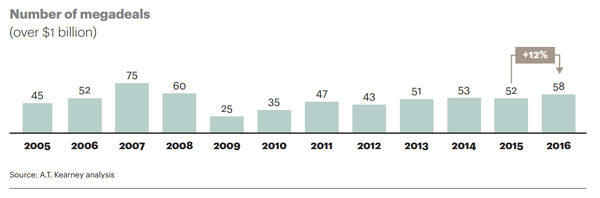

It wasn't just retail tech dealmaking and handshaking though. A.T. Kearney reports that 2016 was a near-record year with $469 billion in consumer and retail deals. Equally as jaw-dropping, the number of megadeals reached 58 in 2016, a 12 percent increase from the previous year and the highest since 2007.

Whether it's the political landscape (perhaps the worry of more legislation and taxes for deals outside the United States) or acquisition shock from last year, 2017 has significantly been a more modest dealmaking year, particularly in tech. In fact, there were 20.96 percent fewer technology, media and telecom deals in the first half of 2017 compared to the first half of 2016 according to the just-released Mergermarket's Global M&A roundup report.

Yes, retailers have bought each other this year for big bucks (Amazon/Whole Foods, Coach/Kate Spade, QVC/Home Shopping Network), but there are many retail companies out there hurting - being sidelined by, according to A.T. Kearney, slumping sales, price deflation and online competition. As such, the consulting company expects more retail deals involving acquiring innovative and specialized businesses. A.T. Kearney also predicts higher-value M&A activity on the far ends of the innovation-to-efficiency spectrum boosting valuations for megadeals and smaller acquisitions.

| Recommended Reading: Retail IT: The Projected Impact of Amazon's Whole Foods Acquisition |

An acquisition announced this morning certainly lives up to the "innovation to efficiency" projection. Retail technology solutions provider Aptos has entered into a definitive agreement to acquire TXT Retail, a global provider of end-to-end merchandise lifecycle management solutions for the apparel, luxury, specialty and general retail sectors.

The acquisition is expected to close Sept. 2017 subject to customary closing conditions and will combine Aptos' customer engagement and inventory management solutions with TXT Retail's merchandise lifecycle management suite. It is deals that aid in agility that will likely be the focus of retail-tech dealmaking this year.

Technology solutions like these help companies be agile if they're willing to invest. As Amazon continues to disrupt business models that were deemed disruptive on their own (e.g., subscription deliveries) like through Prime Wardrobe, retailers will understand that the only way to compete is through agility (being required to sell, downsize or declar bankruptcy if they can't achieve the back-end flexibility that enables modern front-end customer experiences).

| Recommended Reading: Can Retailers Survive Amazon's Entrance Into Subscription Fashion? |

Therefore, retailer-to-retailer deals are all for naught if a company disconnected from all its channels and customers picks up a similar company or starts bogging down innovative companies with the processes and products already not working for the parent company.

Consumer retail deals and retail-tech deals are sure to pick up, and internal and external agility should be the gold standard before, during and after the sale.