Oracle Buys Its Cloud Darling, NetSuite

There's no better way to shake up a Thursday than to wake up to news of yet another multi-billion dollar deal, especially one involving a very hot company in an already red-hot industry.

For anyone (*ahem) who questioned how NetSuite would stay competitive in cloud commerce against Salesforce - which acquired Demandware back in June and has a slew of marketing automation companies under its digital umbrella not to mention its flagship customer relationship management solution - then they'll be very interested to learn that Oracle has entered a definitive agreement to buy NetSuite for approximately $9.3 billion (or 9,300,000,000 for CEOs who like zeros).

Orders, fulfillment, automation, customer relationship management and analytics couldn't get hotter (who's with me?). Here's just 11 ways a NetSuite-Oracle company benefits retailers:

- Create orders

- Fulfill omnichannel transactions (efficiently)

- Bring the website in store

- Manage customer relationships

- Scale

- Retarget shoppers (courtesy of Bronto)

- Automate marketing initiatives

- Pull user-generated content (UGC) onto product pages

- Invoice

- Bridge business/consumer operations

- Leverage an array of analytics, even predictive

The technology that each company will benefit from and pass on to its end-users (the speed at which they do is always the defining factor) is simply mind-blowing (check out Oracle's product list from A-Z and recaps of NetSuite's annual conference, 2014, 2015, 2016). The area in which, personally, will be most interesting to watch is the complete convergence of an enterprise's business to business (B2B) and business to consumer (B2C) operations.

We know today's business buyer is bringing their lofty ecommerce expectations to work with them, and NetSuite foreshadowed its goals a bit with a recent Forrester report commissioned by the cloud company. The survey found that nearly half (48 percent) of B2B sellers said they are aware their customers are comparing the shopping experience they provide with other experiences including those on popular B2C sites. What's more, they're leaning toward a single-stack solution to get them where they need to be (*cough).

While NetSuite has case study after case study of helping wholesalers/retailers/etc., bridge the B2C and B2B gap, Oracle offerings can really bring this B2-everyone idea over the top for enterprises - complete visibility into sales, sentiment, segmentation.

NetSuite has done more than dip its toe into the large-market pond (think Williams-Sonoma, HyperLoop One, Kate Spade), but it was always kind of a gray area as to who NetSuite was going to serve in the long run since Larry Ellison has a majority stake in NetSuite and Oracle (of which Ellison co-founded and where NetSuite Founder Evan Goldberg spent eight years) serves that enterprise-level client.

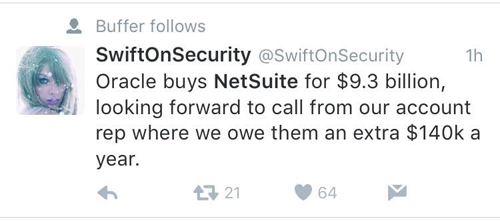

On the flipside, Oracle can now serve smaller commerce operations from the very smallest (running on LightCMS) to the ones on the verge of something great (like GoPro was just a short time ago). How this acquisition will impact costs for everyone, however, is only up for speculation at this point but the Twitterverse has some opinions.

Customers using integrations for NetSuite-Salesforce or Oracle-Salesforce likely have years to figure out which "side" they'll take as Oracle is in year six of a nine-year integration agreement, but the consolidation of the Web has hit a fever pitch and how current integrations and partnerships are impacted over the next couple years will be scary for some and a relief for others as IT is maxed out as it stands today.