Move Over Email - Mobile Wallets Could Be the Next Big Thing for Advertisers

Digital wallet technology has revolutionized how we transact, offering a seamless, secure, and convenient experience for users worldwide. In this article, we explore the who, what, where, when, why, and how of digital wallet technology, delving into its rapid growth, use cases, and potential to become the next major advertising channel.

What are Digital Wallets?

A digital wallet (mobile wallet) is a software-based system that securely stores users' payment information and passwords for numerous payment methods and websites. Users can complete transactions with just a few taps or clicks, making online and in-person purchases more convenient and secure than traditional payment methods. Major players in the industry include Apple Wallet, Google Wallet, and PayPal.

The Birth and Evolution of Digital Wallets

Digital wallet technology first emerged in the late 1990s, but it wasn't until the introduction of smartphones that it gained traction. In 2011, Google launched as the first major digital wallet platform, followed by Apple (known then as Passbook) in 2012. Today, digital wallets are commonplace, with an estimated 2.7 billion users worldwide as of 2021 (source: Statista).

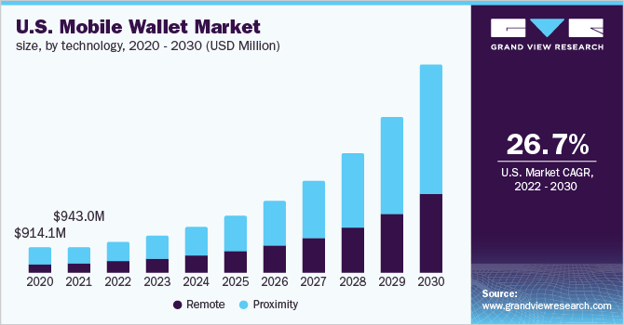

Market Growth and Potential

The global mobile wallet market size was valued at USD 6.2 billion in 2021 and is expanding at a compound annual growth rate (CAGR) of 27.4% from 2022 to 2030. (source: Grand View Research). Factors driving this growth include the proliferation of smartphones, increasing internet penetration, and a growing preference for cashless transactions.

Use Cases

Digital wallets are versatile, catering to a range of use cases such as online shopping, in-store payments, peer-to-peer money transfers, and bill payments. Additionally, digital wallets have expanded to store loyalty cards, tickets, promotional offers and even personal identification documents, making them a comprehensive solution for many aspects of daily life.

- We all know the airline industry and NFL has moved to digital ticketing but here are some others moving into this space,

- Sports organizations can interact with fans more personally with wallet cards such as Fan Pass. Advertisers can promote different offers to those attending games versus those watching from home. Geofencing and Bluetooth beacon technology enable organizations to track users' precise location in stadiums and sports arenas to send them custom promotional messaging.

- Major museums are currently negotiating contracts for wallet cards that use Bluetooth beacons near museum installations to display messages about the exhibits directly to users' phones as they tour the museum.

- Small businesses are using digital card technology to offer their customers special offers through geofencing when users pass within a certain radius from the business. In 2021 retail and ecommerce accounted for 30% of revenue generated by mobile wallets.

- Celebrities are using digital wallet cards to connect with their fanbase with card messages.

- Candidates will also employ digital wallet cards during the upcoming 2024 presidential election as a powerful tool for electorate outreach.

- Health companies and government entities are beginning to offer digitized versions of plastic and paper cards for both convenience and added security; not to mention relevancy. Digital cards using your phone's GPS to show the closest in network health care facilities completely on demand when you need it most.

The Next Big Thing for Advertisers

As digital wallets become increasingly popular, businesses are exploring the potential for targeted advertising within these platforms. By leveraging user data and transaction history, marketers can deliver personalized ads, promotions, and offers, creating a new and potentially lucrative advertising channel.

Non-Pay Transaction Digital Wallet Cards: Revolutionizing Advertising and Loyalty Programs

Non-pay transaction digital wallet cards are gaining traction as an innovative business advertising channel. By integrating loyalty programs, discounts, and special offers directly into digital wallets, companies can enhance customer engagement and drive sales without needing physical cards or paper coupons.

Adoption of Digital Wallet Cards for Discounts, Loyalty Programs, and Special Offers

- According to JD Power as of the third quarter of 2022, 49% of US smartphone users had a mobile wallet app installed on their device. Among them, 39% reported using mobile wallets for loyalty and rewards programs.

- A study by Juniper Research estimates that the number of digital wallet users participating in loyalty programs will reach 3.7 billion by 2025, a significant increase from the 2.5 billion users in 2020 (source: Juniper Research).

- A 2019 report by CodeBroker found that 43% of surveyed consumers would prefer to use their smartphones to access loyalty programs, compared to just 17% who favored using physical cards (source: CodeBroker).

- The Asia-Pacific region accounted for the largest share of the mobile wallet market in 2020, with China dominating the landscape (source: Allied Market Research).

Additional Benefits for Advertisers

Nothing for Consumers to Download Plus Zero Personal Information Required

Unlike apps that require downloading and entering personal details, approving all these permissions, digital wallet users simply scan a QR code or click a link and their information is automatically added to their wallet and shared with the advertiser. Advertisers then manage promotional offers via an advertiser dashboard. Advertisers are charged based on the number of wallet card holders.

The Wallet Group is one of the only companies today offering non-pay transaction wallets and cards for both individuals and brands alike. If you want to learn more about cards or test drive the technology for free click here. This group is pushing the bounds of digital cards in hopes for a transformative new consumer experience all backed by the digital wallet; you can watch it here.

Geofencing Technology

Utilizing geofencing technology, businesses can create virtual boundaries around specific locations, such as their stores or competitors. When customers with digital wallet cards enter these areas, they receive personalized notifications about promotions, discounts, or loyalty rewards, driving foot traffic and increasing conversion rates.

Bluetooth Beacons

Bluetooth beacons offer another way for businesses to engage with customers through digital wallet cards. By emitting signals detectable by smartphones, beacons can trigger targeted advertisements and offers when customers are in close proximity, further refining the personalized experience and fostering brand loyalty.

Win-Win for Businesses and Consumers

Non-pay transaction digital wallet cards provide win-win solutions for businesses and consumers alike. Businesses can boost customer retention, gather valuable insights into consumer behavior, and streamline their loyalty programs. In turn, consumers enjoy a seamless, personalized experience, receiving relevant offers and rewards without the hassle of carrying physical cards or coupons.

Could Displace Email Marketing

As non-pay transaction digital wallet cards continue to gain popularity, businesses must adapt their marketing strategies to capitalize on this emerging channel. By harnessing the power of geofencing and Bluetooth beacons, companies can deliver highly targeted and personalized advertisements, fostering brand loyalty and driving sales in an increasingly competitive market. Email remains one of the most personalized advertising channels. Today, everyone has their phone at all times. A claim can be made that push notifications based on behavioral criteria may be even more personalized and effective than email.

Consumer Privacy and Security

While digital wallet technology offers convenience, it also raises concerns about privacy and security. Industry leaders continue to implement advanced security measures, such as biometric authentication and encryption, to protect user data. However, the use of personal information for targeted advertising may raise ethical concerns that must be addressed as the industry evolves.

Conclusion

The rise of digital wallet technology has transformed the way we transact, providing a seamless and secure experience for users. With the market set for continued growth, and the potential for digital wallets to become a major advertising channel, it is essential for businesses and consumers alike to stay informed and adapt to this rapidly changing landscape. The era of the digital wallet has arrived.