CRO in Practice: Offering Financing to Increase Performance

by Martin Greif

01 Dec, 2017

Cart abandonment is a growing problem for numerous ecommerce merchants. According to eMarketer, merchants will lose an estimated $4.6 trillion worth of revenue due to abandoned carts.

When consumers were asked about their top reasons for leaving items in the cart, 72 percent noted the "cost of order became too expensive" as the reason for cart abandonment. Fortunately, offering financing can help alleviate this problem and help recover lost revenue.

In a recent test, we worked with BBQGuys, an ecommerce site that offers consumers grills ranging from under $100 to over $10,000 to help increase their average order value (AOV) by partnering with fintech startup Bread to implement a financing solution on their website. As a result, BBQGuys saw an increase in AOV by 32.61 percent and saw that customers who used financing had a higher value item order by 24 percent.

In order to promote the financing offer and help BBQGuys achieve this success, four tactics were implemented: establishing trust, prominently displaying the offer, promoting that offer frequently, and making sure the offer was clear and easy to understand.

Establish Trust

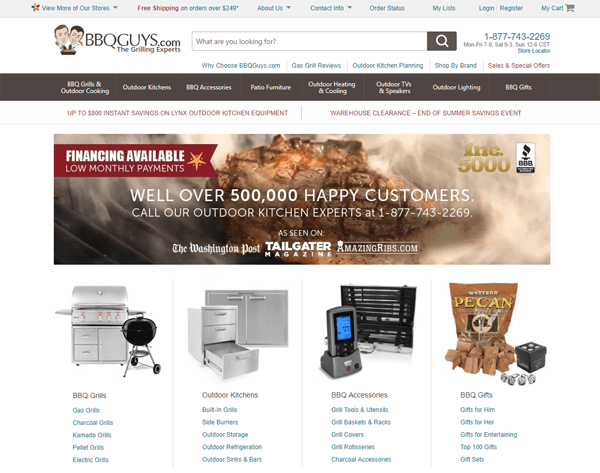

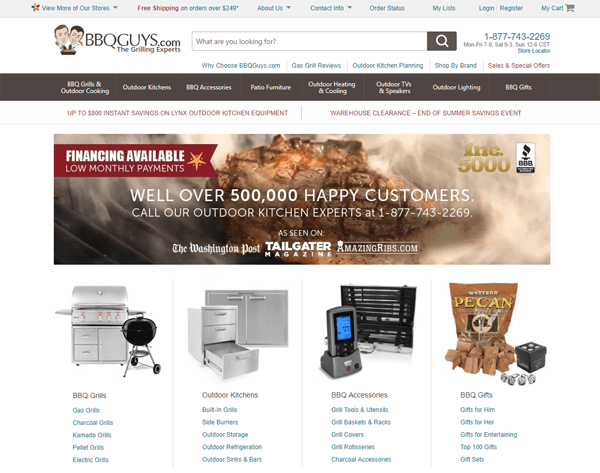

Trust is simple to understand because three things happen when a user visits a website or Web page: they ask themselves are they in the right place; they ask themselves how they feel about the site; and then they figure out what to do next. All three of these lend themselves to generating trust on a site. When a consumer trusts a site, they stay on it longer which is the first step in generating a sale. On the BBQGuys homepage a banner was modified to enhance trust and to introduce the option of financing (see image).

Display the Offer Front and Center

As mentioned, 72 percent of consumers note "cost of order became too expensive" as the reason for cart abandonment. This is why it is important to display the offer clearly on the homepage so the consumer has the opportunity to learn about financing options at the beginning of their customer journey. As shown in the homepage banner, the BBQGuys made sure the financing offer was visible and distinct. The customer learns about the financing offer the minute they land on the homepage.

Promote the Offer Frequently

It is important to promote the offer on the homepage, but what merchants often neglect to do is promote the offer throughout the middle of the customer journey. A majority of the time the customer spends on the website will be on product pages and brands want to make sure they reach the customer in the right place, at the right time. The BBQGuys made sure the financing option was available at every step and the offer was clearly promoted on the product pages (see image).

A proven method to increase conversion rates and AOV is by anchoring the higher price of the item on the left and showing the lower monthly payment on the right. Anchoring the full price, then showing them the lower monthly price, makes the products seem more affordable. It also enables the visitor to shop for more expensive items which increases AOV.

Anchoring can persuade potential customers to jump from a $1,500 grill to a $2,500 grill, for instance. This process of anchoring is continued through to the product detail pages as well (see image).

Make Sure the Offer is Clear and Easy to Understand

When the visitor clicks to learn more, they are presented with a simple pre-qualification screen (see image). One of the advantages of using Bread is it is a white-label platform, so the branding can be customized to meet a site's requirements preventing any confusion for the visitor and ensuring a smooth UX.

The pre-qualification is clear, concise and easy to understand. After the visitor pre-qualifies they are shown exactly what their rate will be. There are no hidden fees or charges, re-emphasizing that first element of trust.

Once the customer pre-qualifies, they are presented the information as "great news." They are shown not only their rate, but also how much they are qualified, which can lead to increasing the order value as they know now what their available credit limit is (see image).

The customer is presented with instructions on how to use their financing at checkout making the process seamless and easy.

As a result of these four tactics and the Bread Finance implementation, the BBQGuys saw an impressive 9.5 percent increase in conversion rate as well as:

+ Increased percentage of revenue from financing by an average of +61.58 percent

+ Finance customers had a higher AOV by +32.61 percent against customers who did not use financing

+ Finance customers had a higher items per order by +24 percent versus customers who did not use financing

By establishing trust and offering Bread financing throughout the product pages, the BBQGuys was able to let their customers know early on that they could make a larger purchase and pay over time.

Conclusion

When implementing financing, enterprises need to make sure visitors are aware of their options so their organization can reap the benefits:

1. Make the ability to finance purchases prominent throughout the site.

2. Make financing messaging benefits-based and precise.

3. On critical pages, place the monthly amount beside the full price, so brands can take advantage of anchoring.

4. Make sure the "pay over time" option gets enough visual emphasis.

Implemented well, great technology can have a massive impact on an enterprise's bottom line.

About the Author

Martin Greif brings 25-plus years of sales and marketing experience to SiteTuners (host of Digital Growth Unleashed) where he is responsible for driving revenue growth, establishing and nurturing partner relationships and creating value for its broad customer base.

When consumers were asked about their top reasons for leaving items in the cart, 72 percent noted the "cost of order became too expensive" as the reason for cart abandonment. Fortunately, offering financing can help alleviate this problem and help recover lost revenue.

In a recent test, we worked with BBQGuys, an ecommerce site that offers consumers grills ranging from under $100 to over $10,000 to help increase their average order value (AOV) by partnering with fintech startup Bread to implement a financing solution on their website. As a result, BBQGuys saw an increase in AOV by 32.61 percent and saw that customers who used financing had a higher value item order by 24 percent.

In order to promote the financing offer and help BBQGuys achieve this success, four tactics were implemented: establishing trust, prominently displaying the offer, promoting that offer frequently, and making sure the offer was clear and easy to understand.

Establish Trust

Trust is simple to understand because three things happen when a user visits a website or Web page: they ask themselves are they in the right place; they ask themselves how they feel about the site; and then they figure out what to do next. All three of these lend themselves to generating trust on a site. When a consumer trusts a site, they stay on it longer which is the first step in generating a sale. On the BBQGuys homepage a banner was modified to enhance trust and to introduce the option of financing (see image).

Display the Offer Front and Center

As mentioned, 72 percent of consumers note "cost of order became too expensive" as the reason for cart abandonment. This is why it is important to display the offer clearly on the homepage so the consumer has the opportunity to learn about financing options at the beginning of their customer journey. As shown in the homepage banner, the BBQGuys made sure the financing offer was visible and distinct. The customer learns about the financing offer the minute they land on the homepage.

Promote the Offer Frequently

It is important to promote the offer on the homepage, but what merchants often neglect to do is promote the offer throughout the middle of the customer journey. A majority of the time the customer spends on the website will be on product pages and brands want to make sure they reach the customer in the right place, at the right time. The BBQGuys made sure the financing option was available at every step and the offer was clearly promoted on the product pages (see image).

A proven method to increase conversion rates and AOV is by anchoring the higher price of the item on the left and showing the lower monthly payment on the right. Anchoring the full price, then showing them the lower monthly price, makes the products seem more affordable. It also enables the visitor to shop for more expensive items which increases AOV.

Anchoring can persuade potential customers to jump from a $1,500 grill to a $2,500 grill, for instance. This process of anchoring is continued through to the product detail pages as well (see image).

Make Sure the Offer is Clear and Easy to Understand

When the visitor clicks to learn more, they are presented with a simple pre-qualification screen (see image). One of the advantages of using Bread is it is a white-label platform, so the branding can be customized to meet a site's requirements preventing any confusion for the visitor and ensuring a smooth UX.

The pre-qualification is clear, concise and easy to understand. After the visitor pre-qualifies they are shown exactly what their rate will be. There are no hidden fees or charges, re-emphasizing that first element of trust.

Once the customer pre-qualifies, they are presented the information as "great news." They are shown not only their rate, but also how much they are qualified, which can lead to increasing the order value as they know now what their available credit limit is (see image).

The customer is presented with instructions on how to use their financing at checkout making the process seamless and easy.

As a result of these four tactics and the Bread Finance implementation, the BBQGuys saw an impressive 9.5 percent increase in conversion rate as well as:

+ Increased percentage of revenue from financing by an average of +61.58 percent

+ Finance customers had a higher AOV by +32.61 percent against customers who did not use financing

+ Finance customers had a higher items per order by +24 percent versus customers who did not use financing

By establishing trust and offering Bread financing throughout the product pages, the BBQGuys was able to let their customers know early on that they could make a larger purchase and pay over time.

Conclusion

When implementing financing, enterprises need to make sure visitors are aware of their options so their organization can reap the benefits:

1. Make the ability to finance purchases prominent throughout the site.

2. Make financing messaging benefits-based and precise.

3. On critical pages, place the monthly amount beside the full price, so brands can take advantage of anchoring.

4. Make sure the "pay over time" option gets enough visual emphasis.

Implemented well, great technology can have a massive impact on an enterprise's bottom line.

About the Author

Martin Greif brings 25-plus years of sales and marketing experience to SiteTuners (host of Digital Growth Unleashed) where he is responsible for driving revenue growth, establishing and nurturing partner relationships and creating value for its broad customer base.

Martin Greif

Martin is the President of SiteTurners.com, a company that helps businesses overcome growth challenges. Clients turn to SiteTurners when they face increased acquisition costs, stagnant revenue and conversion rates, and difficulties scaling their operations. With a focus on testing and marketing funnel optimization, Martin and his team aim to help businesses generate more sales, leads, and subscriptions and achieve their desired growth.

Subscribe to Our Newsletter!

Latest in Marketing