Gambling on Alternative Payment Options

Every detail of the checkout page has an impact on consumers' purchasing decisions.

As such, merchants must always stay up-to-date on the latest technology and trends that affect conversions, including alternative payment solutions that may be worth the gamble.

The Safe Bet: PayPal

PayPal has already proven to be a safe bet in the ecommerce industry, as the payment platform has more than 152 million active registered accounts and processes upward of 9.3 million payments every day. For merchants, PayPal offers a variety of solutions that enable both small and large ecommerce businesses to offer a speedy and secure checkout on both the traditional and mobile Web.

For example, PayPal's Standard and Pro plans enable merchants to accept the top payment options, from a basic PayPal account to credit and debit cards. Both plans accept PayPal Credit (previously called Bill Me Later), which is essentially a financing option that gives consumers the ability to check out quickly and pay for their purchases over time. Merchants are still paid up front when consumers choose PayPal Credit, and payments typically show up in the merchant's PayPal account within minutes after an order is complete. According to the company, merchants who include PayPal Credit on their sites can boost sales by up to 18 percent.

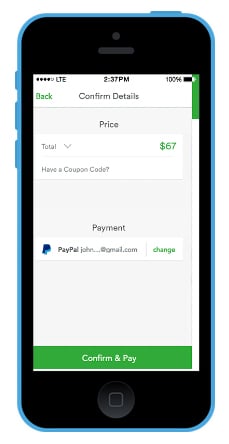

More recently, PayPal launched its One Touch solution that Internet retailers can integrate into their mobile apps to speed up the checkout process. Once implemented, consumers making purchases with PayPal are no longer required to enter any personal information, including user IDs or passwords. Rather, PayPal information is stored within apps after consumers log in once on their device, enabling them to simply click "Buy" to complete future purchases.

Merchants can speed up the mobile checkout process with PayPal's new "One Touch" solution.

The Hot Tip: Visa Checkout

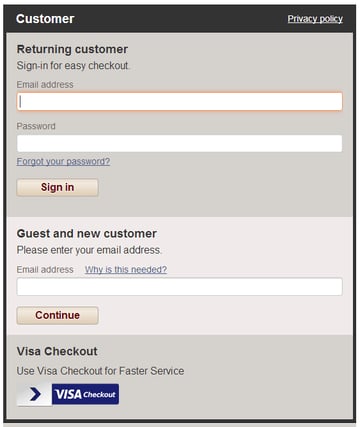

Visa made an attempt to simplify the checkout in July 2014, when the popular credit card company launched its Visa Checkout payment option. If the concept sounds familiar, it's because Visa Checkout is replacing the company's previous V.me by Visa offering. The payment offering is similar in scope to PayPal as it enables consumers to create an account to streamline the checkout process on participating retailers' websites.

Consumers simply connect their Visa Checkout accounts to a credit or debit card, and then enter their usernames and passwords to complete the payment process on websites with Visa Checkout functionality (early adopters include Pizza Hut, Old Navy/Gap, Karmaloop and Staples).

Merchants looking to join these popular retailers may also be interested to know that Visa Checkout can not only be implemented on their websites, but also in their native mobile apps through a mobile SDK for both iOS and Android. The mobile capabilities further establish Visa's goal of bringing the simplicity and speed of the real-world "swipe" to online commerce.

Visa Checkout is available at Gap.com - one of the payment solution's early adopters.

The Gamble: Bitcoin

Bitcoin is a type of virtual currency that is slowly generating increasing attention from the general public. Despite the buzz, however, few know much about Bitcoin. Learn what Bitcoin is, what it isn't and whether it will be the future of currency in this infographic at wsm.co/bitcoinbuzz.

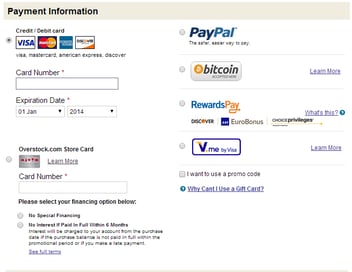

While Bitcoin isn't a widely accepted form of payment yet, it is a type of currency that merchants should keep on their radar. After all, some big-name companies have already started accepting Bitcoin, including WordPress.com, OKCupid and Overstock.com.

For merchants interested in betting on Bitcoin there are quite a few benefits, including the fact the Bitcoin is a global currency and typically doesn't cost as much to process as other forms of payments - implementation isn't too difficult either. For instance, merchants can leverage Bitcoin wallet platform Coinbase to start accepting Bitcoin. Coinbase doesn't charge any fees for the first million dollars of Bitcoin payments processed. After that, merchants are charged just 1 percent to convert Bitcoin payments to cash. Comparatively, PayPal charges 2.9 percent plus $0.30 per transaction.

Believe it or not, Bitcoin isn't the most-progressive payment solution on the market. Learn about the just-announced ApplePay at wsm.co/applepay101.

Overstock.com offers a variety of alternative payment options, including Bitcoin.

Rolling the Dice

When making the decision to implement new payment options onto an ecommerce site, it is important to take into consideration the preferences of your store's unique customer base. In addition, Mark Lavelle, SVP of product and strategy at eBay Enterprise and Magento says that merchants should keep in mind that offering too many payment options can also pose a risk.

"You don't want to distract them with too many options, you don't want to distract them with too many steps - you don't want to concern them about security," said Lavelle.

Subscribe to Our Newsletter!

Latest in Marketing